Notice of 2018 Annual Meeting and Proxy Statement 2023

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Pursuant to §240.14a-12 | |

VISA INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |||

| ☐ | Fee | |||

| ||||

|

| |||

|

| |||

|

| |||

|

| |||

| ☐ | ||||

| ||||

|

| |||

|

| |||

|

| |||

Notice of 2018 Annual Meeting and Proxy Statement 2023

Dear Fellow Stockholder,

On behalf of the Board of Directors, we want to thank you for your investment in Visa and encourage you to vote your shares by proxy at this year’s Annual Meeting. There are five matters on the agenda: the election of directors, Say-on-Pay, advisory vote on the frequency of future advisory votes on executive compensation, ratification of the auditors, and one stockholder proposal.

At Visa, we are guided by our purpose, which is to uplift everyone, everywhere by being the best way to pay and be paid. Our purpose is demonstrated in our business and in our environmental, social, and governance (ESG) efforts, which are an important priority for Visa and continue to be an increasing focus for our investors, partners, and employees, as well as governments and other stakeholders.

Our Board oversees our ESG strategy and activities at both the full Board and committee levels, with the Nominating and Corporate Governance Committee having formal responsibility for oversight of our ESG policies and programs. Throughout the year, we made significant progress across each of our five ESG pillars: Empowering People & Economies, Securing Commerce & Protecting Customers, Investing in Our Workforce, Protecting the Planet, and Operating Responsibly. Some highlights across these pillars include:

We have helped digitally enable over 40 million small and micro businesses as of September 2022, as we work toward our goal of reaching 50 million by the end of 2023.

We have invested over $10 billion in technology over the last five years, including to reduce fraud and enhance network security.

We achieved the highest rating in our sector from Gartner Consulting during our 2022 cybersecurity program review.

We supported more than 6,000 employees from 58 countries who volunteered more than 55,000 hours to strengthen the communities in which we live and work.

We completed the first year of the Visa Black Scholars and Jobs Program, hosted the inaugural Visa Black Scholars Summit, and welcomed our second cohort of scholars to continue building on the momentum of the program.

We received third party validation of our 2030 science-based target as an interim goal toward our 2040 net zero target. This builds on Visa’s achievement of purchasing 100% renewable electricity and attaining carbon neutrality for our operations in 2020.

We advanced on our aspiration to be a climate positive company through expanded sustainability solutions, such as the Visa Eco Benefits bundle, for our clients.

We continued to receive recognition of our ESG leadership from third-party organizations, including inclusion in the Bloomberg Gender Equality Index, the Dow Jones Sustainability North America Index for the fifth consecutive year, and Ethisphere’s World’s Most Ethical Companies for the tenth consecutive year.

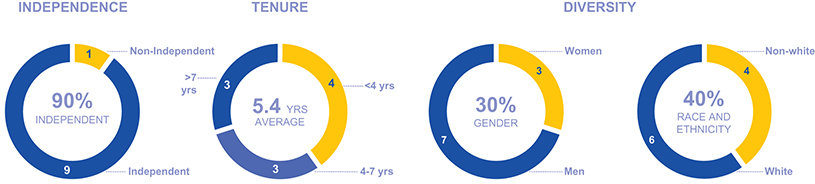

This year, Visa’s corporate governance practices continued to help promote long-term value and strong Board and management accountability to our diverse set of stakeholders. The Board is focused on prioritizing the right mix of skills, qualifications, experiences, tenure, and diversity to promote and support Visa’s long-term strategy. Women comprise 30% of the Board’s nominees, and 40% of the Board’s nominees are racially or ethnically diverse. During 2022 we welcomed two independent directors to the Board, Teri L. List and Kermit R. Crawford. Teri and Kermit each bring decades of senior leadership experience to the Board, providing diverse perspectives and expertise that will be invaluable to Visa. In addition, Mary Cranston and Bob Matschullat will be retiring from the Board at this year’s Annual Meeting after contributing 15 years of distinguished leadership and service, including as committee chairs, and with Bob serving as our former Chairman of the Board. On behalf of the Board, we sincerely thank Mary and Bob for their dedicated service and many contributions to Visa over the years.

Finally, as we have recently announced, we are pleased to share that Ryan McInerney will be Visa’s next Chief Executive Officer, and Al Kelly will move to the role of Executive Chairman, both effective February 1, 2023. The Board of Directors also expects to appoint Ryan to the Board effective upon his transition to Chief Executive Officer. This leadership change reflects the Board’s thoughtful and well-established approach to succession. Ryan is a very seasoned leader in the payments and consumer banking industry. In his role as President over the past 10 years, Ryan has been responsible for Visa’s global businesses, delivering value to the company’s financial

institutions, acquirers, merchants, and partners in more than 200 countries and territories around the world. He has overseen the company’s market teams, business units, product team, merchant team, and client services. We look forward to working with Ryan to continue to drive Visa’s success, growth, and innovation.

Thank you for your continued support of Visa, and we look forward to your attendance at this year’s Annual Meeting.

|

| |

Chairman and

Chief Executive Officer |

John Lundgren Lead Independent Director |

Items of Business

| 1. |

|

| 2. |

|

| 3. |

|

| 4. | To ratify the appointment of KPMG LLP as our independent registered public accounting firm for fiscal year |

| 5. | To vote on a stockholder proposal requesting an independent board chair policy; and |

| 6. |

|

The proxy statement more fully describes these proposals.

Record Date

Holders of our Class A common stock at the close of business on November 25, 2022 are entitled to notice of and to vote on all proposals at the Annual Meeting and any adjournment or postponement thereof.

Attending the Annual Meeting

The meeting will be held on Tuesday, January 24, 2023 at 8:30 a.m. Pacific Time. Log-in begins at 8:15 a.m. Eligible holders of our Class A common stock will be able to attend the meeting online, vote their shares electronically, and submit questions during the meeting by visiting virtualshareholdermeeting.com/V2023. To participate in the virtual meeting, you will need the 16-digit control number included on your Notice of Internet Availability of Proxy Materials, proxy card, or voting instruction form. Please refer to the “Attending the Meeting” section of the proxy statement for more details about attending the Annual Meeting online. This year’s meeting will be held exclusively online; we are not holding an in-person meeting.

Proxy Voting

Your vote is very important. Whether or not you plan to attend the Annual Meeting online, please vote at your earliest convenience by following the instructions in the Notice of Internet Availability of Proxy Materials or the proxy card you received in the mail. You may revoke your proxy at any time before it is voted. Please refer to the “Voting and Meeting Information” section of the proxy statement for additional information.

On December 1, 2022, we released the proxy materials to the stockholders of our Class A common stock and sent to these stockholders (other than those Class A stockholders who previously requested electronic or paper delivery) a Notice of Internet Availability of Proxy Materials containing instructions on how to access our proxy materials, including our proxy statement and our fiscal year 2022 Annual Report, and to vote through the Internet or by telephone.

By Order of the Board of Directors

Kelly Mahon Tullier

Executive Vice President, GeneralChair, Chief People and Administrative Officer,

Counsel and Corporate Secretary

Foster City,San Francisco, California

December 7, 20171, 2022

Important Notice Regarding the Availability of Proxy Materials

for the 20182023 Annual Meeting of Stockholders to be held on January 30, 2018. 24, 2023.

The proxy statement and Visa’s Annual Report for fiscal year 20172022 are available athttp://investor.visa.com.

| investor.visa.com | . |

i

This summary highlights information contained elsewhere in this proxy statement. This summary does not contain all of the information that you should consider, and you should read the entire proxy statement carefully before voting.

INFORMATION ABOUT OUR 2023 ANNUAL MEETING OF STOCKHOLDERS

| Date and Time | Tuesday, January 24, 2023 at 8:30 a.m. Pacific Time | ||

| Place | This year’s meeting will be held virtually via a live webcast at virtualshareholdermeeting.com/V2023 | ||

| Record Date | November 25, 2022 | ||

VOTING MATTERS

|

| Proposals

| Board

| Page Number

| |||

| 1

| Election of ten director nominees

| FOR (each nominee)

| 34

| |||

| 2

| Approval, on an advisory basis, of compensation paid to our named executive officers

| FOR

| 87

| |||

| 3

| Advisory vote on the frequency of future advisory votes to approve executive compensation

| ONE YEAR

| 87

| |||

| 4

| Ratification of the appointment of our independent registered public accounting firm

| FOR

| 88

| |||

| 5

| To vote on a stockholder proposal requesting an independent board chair policy

| AGAINST

| 90

| |||

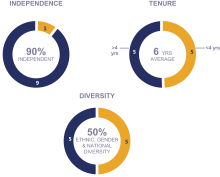

CORPORATE GOVERNANCE AND BOARD HIGHLIGHTS

We are committed to corporate governance practices that promote long-term value and strengthen Board and management accountability to our stockholders, customers, and other stakeholders. Information regarding our corporate governance framework begins on page 10, which includes the following highlights:

Number of director nominees | 10 | Demonstrated commitment to Board refreshment |

| |||

Percentage of independent director nominees | 90% | Annual Board, committee, and director evaluations |

| |||

Directors attended at least 75% of meetings |

| Regularly focus on director succession planning |

| |||

Annual election of directors |

| Risk oversight by full Board and committees |

| |||

Majority voting for directors |

| Stock ownership guidelines for directors and executive officers |

| |||

Proxy access (3%/3 years) |

| Proactive, ongoing engagement with stockholders |

| |||

Robust Lead Independent Director duties |

| ESG oversight by full Board and committees |

| |||

Regular executive sessions of independent directors |

| Political Participation, Lobbying and Contributions Policy |

| |||

Snapshot of 2023 Director Nominees

Our director nominees exhibit an effective mix of diversity, experience, and perspectives

Director Since |

Committee | Other Current Public Boards | ||||||||||||||||||

| Name | Principal Occupation | Independent | ARC | CC | FC | NCGC | ||||||||||||||

| Lloyd A. Carney | 2015 | Founder and Chief Acquisition Officer, Carney Technology Acquisition Corp II | ✓ |

|

|

|

| 2 | |||||||||||

|

Kermit R. Crawford |

2022 |

Director |

✓ |

(1) |

(1) |

2 | |||||||||||||

| Francisco Javier Fernández-Carbajal | 2007 | Director General, Servicios Administrativos Contry SA de CV | ✓ | ● | ● |

| 3 | ||||||||||||

| Alfred F. Kelly, Jr. | 2014 | Chairman and CEO, Visa |

– |

|

|

| – | ||||||||||||

| Ramon Laguarta | 2019 | Chairman and CEO, PepsiCo, Inc. |

✓ | ● |

|

| ● | 1 | |||||||||||

| Teri L. List | 2022 | Director |

✓ | ● | ● |

|

| 3 | |||||||||||

| John F. Lundgren |

2017 |

Lead Independent Director, Visa | ✓ |

| ● |

| ● |

1 | |||||||||||

| Denise M. Morrison | 2018 | Founder, Denise Morrison & Associates, LLC | ✓ | ● |  |

|

| 2 | |||||||||||

| Linda J. Rendle | 2020 | CEO, The Clorox Company | ✓ | ● | ● | 1 | |||||||||||||

| Maynard G. Webb, Jr. | 2014 | Founder, Webb Investment Network | ✓ |

|

| ● |  | 1 | |||||||||||

ARC = Audit and Risk Committee CC = Compensation Committee FC = Finance Committee NCGC = Nominating and Corporate Governance Committee |

|

(1) | Kermit R. Crawford will join the ARC and NCGC effective January 1, 2023. |

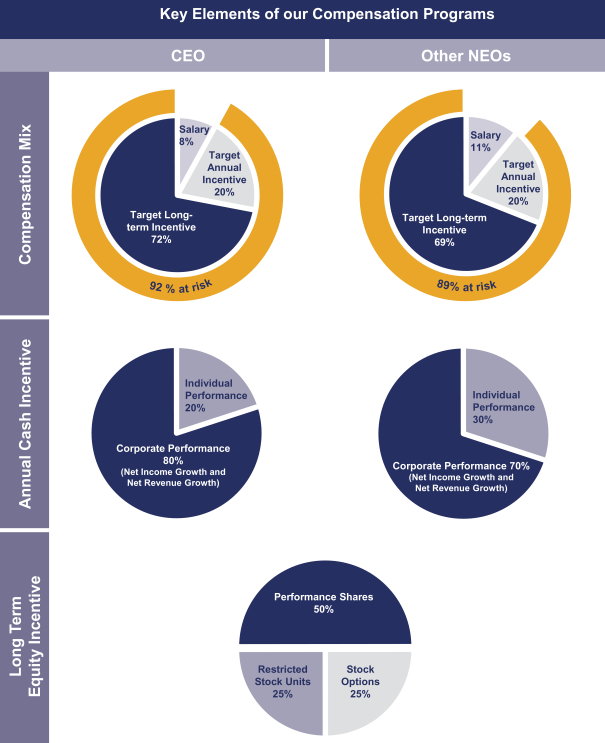

Our Compensation Philosophy, Principles, and Key Elements

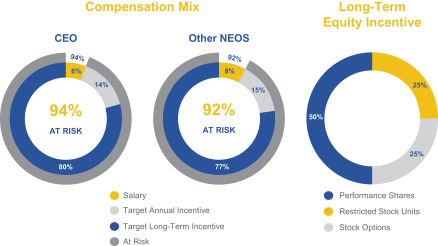

The compensation program for our named executive officers (NEOs) helps us attract and retain key talent and promote performance that enhances stockholder value and drives long-term strategic outcomes, including the Company’s broader ESG efforts.

There are three primary principles that guide our compensation program design and administration: (1) pay for performance; (2) promote alignment with stakeholders’ interests; and (3) attract, motivate, and retain key talent.

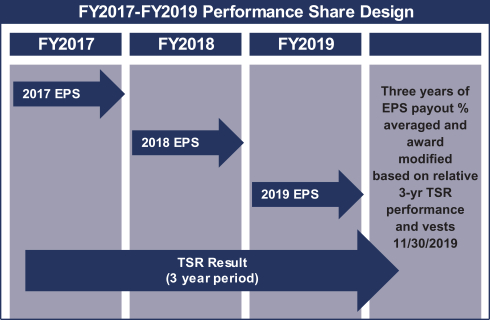

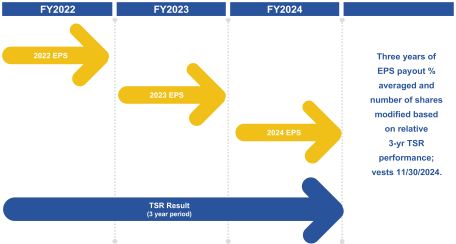

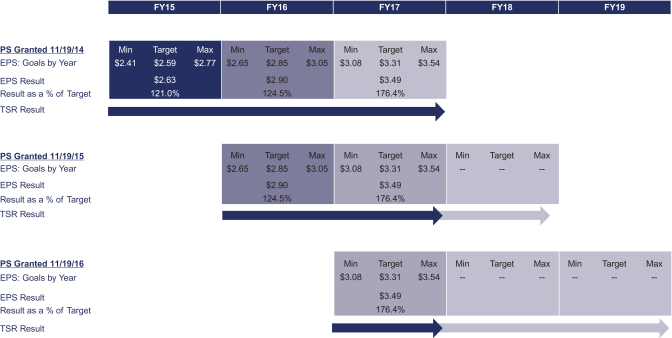

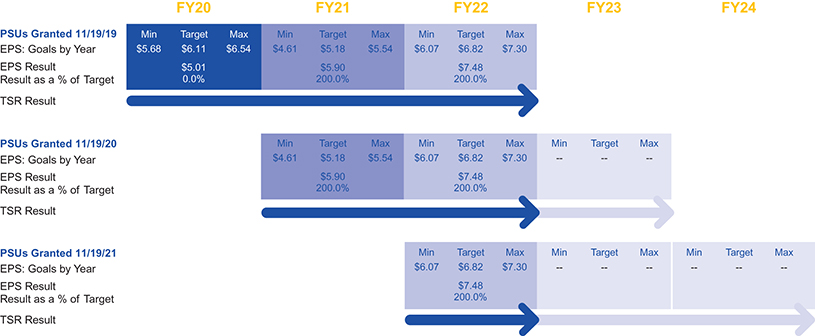

We tie a substantial portion of our NEOs’ target annual compensation to the achievement of pre-established financial and non-financial objectives that support our business strategy, with a mix that balances short- and long-term performance goals. Further, our annual incentive plan incorporates ESG metrics that are tied to the Company’s strategic objectives. Our long-term equity awards align the interests of our NEOs with our stakeholders’ interests and link a substantial portion of compensation to the achievement of earnings per share (EPS) results that drive stockholder value and relative total shareholder return (TSR).

For fiscal year 2022, 94% of the target total direct compensation for our Chairman and Chief Executive Officer was variable and at risk, and an average of 92% was variable and at risk for our other NEOs.

Compensation |

| Link to Strategy |

| Strategy & | ||||

Annual Incentive Plan | ● Based on a scorecard that incorporates metrics in four categories, each of which is aligned with our corporate strategy: Financial; Client; Foundational; and Operational Excellence, Talent, & ESG ● Year-end performance is evaluated against pre-established performance goals in the scorecard ● Final payout is based on the Compensation Committee’s analysis of the Company’s performance against all scorecard metrics and individual performance | Aligns NEOs’ interests with stakeholders’ interests by: ● rewarding performance for achievement of strategic goals, which are designed to position the Company competitively ● promoting strong financial results and stockholder value | ||||||

Long-Term Equity Awards | ● Substantial portion of compensation is linked to achievement of long-term corporate performance using equity incentives, including performance shares based on EPS and relative TSR results over three years ● Individual performance, which is tied to our strategic objectives, is considered in setting the value of our NEOs’ long-term equity grants ● The number of performance shares that ultimately vests at the end of the three-year performance period is formulaic and based on pre-established performance conditions | Further aligns NEOs’ interests with stakeholders’ interests by: ● taking company and individual performance into account in determining equity grant values ● linking a substantial portion of long-term compensation to the achievement of EPS results that drive stockholder value and relative TSR | ||||||

Principles of our Compensation Program | ||

Pay for Performance | The key principle of our compensation philosophy is pay for performance. We favor variable “at risk” pay opportunities over fixed pay, with a significant portion of our NEOs’ total compensation determined based on performance against annual and long-term goals and stockholder return. | |

Promote Alignment with Stakeholders’ Interests | We reward performance that meets or exceeds the goals that the Compensation Committee establishes with the objective of increasing stockholder value over time, aligning with other stakeholders’ interests, and driving long-term strategic outcomes, including the Company’s broader ESG efforts. | |

Attract, Motivate, and Retain Key Talent | We design our compensation program to attract, motivate, and retain key talent. | |

Key Elements of our Fiscal Year 2022 Compensation Program

EXECUTIVE COMPENSATION PROGRAM HIGHLIGHTS

| WHAT WE DO: | ||

| Pay for performance | |

| Annual say-on-pay vote | |

| Recoupment policies | |

| Short-term and long-term incentives/measures | |

| Capped incentive awards | |

| Independent compensation consultant | |

| Stock ownership guidelines | |

| Limited perquisites | |

| Proactive, ongoing engagement with stockholders | |

| Pay linked to ESG factors | |

| WHAT WE DO NOT DO: | ||

| Gross-up excise taxes | |

| Reprice stock options | |

| Provide fixed-term employment agreements | |

| Provide for single-trigger severance arrangements | |

| Allow hedging and pledging of Visa securities | |

FISCAL YEAR 2022 COMPANY HIGHLIGHTS

During the fiscal year ended September 30, 2022, Visa delivered strong financial results, with net revenues, net income, and EPS all up more than 20% year-over-year.

| NET REVENUES | GAAP NET INCOME | NON-GAAP NET INCOME(1) | ||

| $29.3B | $15.0B | $16.0B | ||

| up 22% from prior year | up 21% from prior year | up 24% from prior year |

| DIVIDENDS & | ||||

| GAAP EPS | NON-GAAP EPS(1) | SHARE BUYBACKS | ||

| $7.00 | $7.50 | $14.8B | ||

| up 24% from prior year | up 27% from prior year | up 29% from prior year |

| (1) | For further information regarding non-GAAP adjustments, including a reconciliation of our GAAP to non-GAAP financial results, please see Item 7 – Management’s Discussion and Analysis of Financial Condition and Results of Operations – Overview in our 2022 Annual Report on Form 10-K as filed with the Securities and Exchange Commission on November 16, 2022. |

BOARD’S ROLE IN LONG-TERM STRATEGIC PLANNING

The Board takes an active role with management to formulate and review Visa’s long-term corporate strategy. Each quarter, the Board and management confer on the execution of our long-term strategic plans, and the status of key initiatives, opportunities, and risks facing Visa. In addition, the Board regularly conducts in-depth long-term strategic reviews with our senior management team. During these reviews, the Board and management discuss the payments landscape, emerging technological and competitive threats, and short- and long-term plans and priorities within our strategy.

Additionally, the Board annually discusses and approves the budget and capital requests, which are firmly linked to Visa’s long-term strategic plans and priorities. Through these processes, the Board brings its collective, independent judgment to bear on the most critical long-term strategic issues facing Visa. For more information on our long-term strategy and the progress we made against our strategic goals in fiscal year 2022, please see our 2022 Annual Report, including the letter from our Chairman and Chief Executive Officer, Alfred F. Kelly, Jr., to our stockholders.

TALENT AND HUMAN CAPITAL MANAGEMENT

Attracting, developing, and advancing the best people globally is crucial to all aspects of Visa’s activities and long-term success, and is central to our long-term strategy. Best-in-class, diverse teams and an inclusive culture inspire leadership, encourage innovative thinking, and support the development and advancement of all employees.

These guiding principles have been more important than ever in light of the continuing challenges posed by events such as the COVID-19 pandemic and the impact of developments related to the war in Ukraine. At Visa, we are committed to the health and safety of our employees and their families. In fiscal year 2022, a large majority of our workforce continued to work remotely for the first half of the year, and we maintained strong safety protocols and procedures consistent with applicable requirements and guidelines for the employees who continued to work on site. To meet the evolving needs of our workforce, we deepened our commitment to employee wellbeing, through broad engagement with our leadership, targeted programs, and expanded benefits. We also executed a phased approach to reopening our offices, with employee health and wellbeing as a top priority. We are providing our employees with enhanced flexibility in how and where we work while maintaining collaboration and community. As we plan for the future of work, we expect to monitor and evolve our approach to continue to provide the right flexible balance for Visa.

At Visa, all employees are encouraged and empowered to be leaders through embracing the Visa Leadership Principles. These Leadership Principles are integrated into core talent processes, and employees are evaluated not only on their performance, but also how they embody the Leadership Principles:

We lead by | We excel with partners | We communicate openly | We act decisively | We enable and | We collaborate | |||||

Be accountable Treat others with Demonstrate a | Build strong Provide excellent Take a solutions- oriented approach | Promote a shared Communicate Value others’ | Challenge the Decide quickly Learn from our | Inspire success Remove barriers Value inclusivity and | Break down silos Engage with our Deliver as One Team | |||||

The tone and culture of Visa is set at the Board level. The full Board has oversight of human capital management and performs regular reviews, including annual reviews of succession planning for our Chief Executive Officer. Our Board committees have responsibility for specific areas of human capital management. The Nominating and Corporate Governance Committee is responsible for director succession and refreshment, as well as management succession and development planning. Our Compensation Committee is responsible for reviewing Visa’s programs and practices related to executive workforce inclusion and diversity as well as the administration of compensation programs in a non-discriminatory manner. Management is responsible for developing policies and processes that reflect and reinforce our desired corporate culture, including policies and processes related to strategy, risk management, and ethics and compliance.

Employee Development and Engagement

Visa understands that being an employer of choice requires best-in-class career and skills development along with innovative programs. This year, we introduced a career framework with philosophies and tools for employees to plan their growth and career at Visa. We also implemented new guidelines to drive increased internal mobility for employees. We support employees in their development through our award-winning Visa University. Our global learning platform, Learning Hub, houses more than 200,000 learning resources on a number of topics, including sales, technology, product, and leadership development training on our gamified platform. Visa’s annual Learning Festival includes courses taught and facilitated by Visa leaders and external speakers who bring real-world context and ideas for practical application that are aligned with our goals.

We recognize that building an inclusive and high-performing culture requires an engaged workforce, where employees are motivated to do their best work every day. Our engagement approach centers on communication and recognition. We communicate with our employees in a variety of ways, including biweekly video updates from our Chairman and Chief Executive Officer, company intranet, digital signage, email newsletters, live events in regional offices, and quarterly all-staff meetings. Our recognition programs include our Go Beyond platform, where managers and peers recognize employees who exemplify our leadership principles. In 2022, we created our new Employee Value Proposition, Powering Payments, Empowering People, which is closely linked to our purpose and will be used to attract, develop, and advance top-notch talent.

We assess employee engagement through a variety of channels, including employee pulse surveys, which provide feedback on a variety of topics, such as company direction and strategy, wellbeing, inclusion and diversity, individual growth and development, collaboration, and confidence and pride.

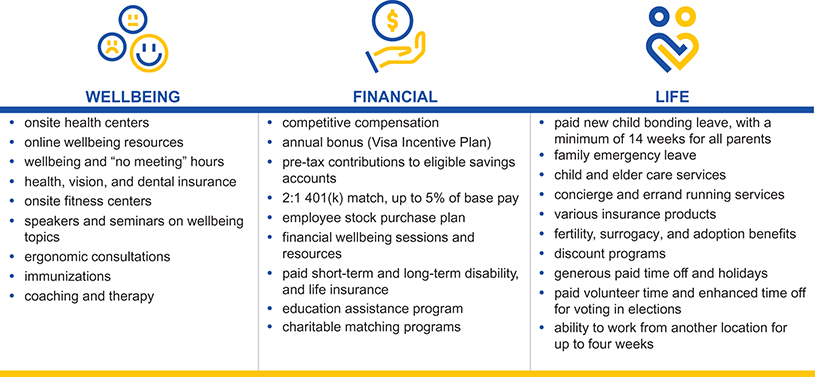

Employee Benefits

We believe our employees are critical to the success of our business, and we structure our total rewards and benefits package to attract and retain a talented and engaged workforce. We continue to evolve our programs to meet our employees’ needs, providing comprehensive wellbeing, financial, and quality of life coverage. Our programs vary by location, but may include the following:

Inclusion and Diversity

Visa believes in an inclusive and diverse workplace where everyone is accepted, everywhere. We are driven to create a culture in which individual differences, experiences, and capabilities are valued and contribute to our business success. By leveraging the diverse backgrounds and perspectives of our worldwide teams, we are able to achieve better solutions for our clients and create a connected workplace to attract and advance top talent. Visa’s approach to inclusion and diversity involves the following:

We are committed to doing our part to improve our inclusion and increase our diversity. Visa is driving important change through specific actions, including making progress toward our goals to increase the number of U.S. employees from underrepresented groups, continuing to support the Visa Black Scholars and Jobs Program, and hosting a “Global Inclusion Talks” series to promote internal education and conversation. We are also providing professional development and mentorship programs, equipping our employees with training and tools to be active allies, and enhancing our supplier diversity efforts.

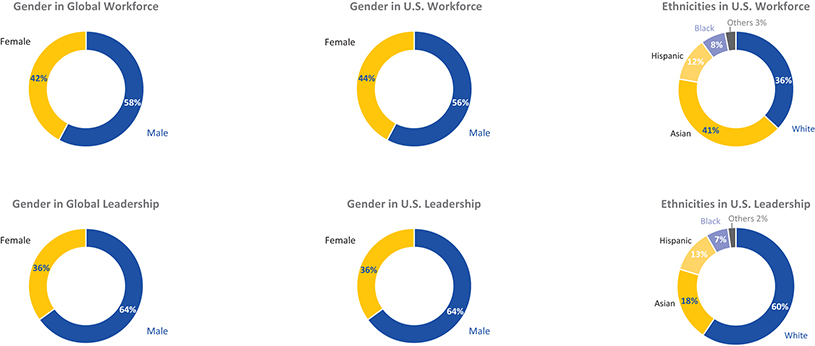

Workforce Demographics

Visa tracks, measures, and evaluates our workforce representation and impact as part of our strategic business imperative to build a diverse and inclusive organization. We are committed to reporting our workforce demographics annually.

Notes:

Demographic data is based on Company records as of September 30, 2022.

Leadership: Defined as Vice President and above.

Others: Defined as American Indian/Alaska Native, Native Hawaiian/Other Pacific Islander, and two or more races. Ethnicity data does not include employees who choose not to disclose or who leave the field blank.

Members of our Board oversee our business through discussions with our Chief Executive Officer; President; Vice Chair, Chief Financial Officer; Vice Chair, Chief People and Administrative Officer, and Corporate Secretary; General Counsel; Chief Risk Officer; President, Technology; and other officers and employees, and by reviewing materials provided to them and participating in regular meetings of the Board and its committees.

The Board regularly monitors our corporate governance policies and profile to confirm we meet or exceed the requirements of applicable laws, regulations and rules, and the listing standards of the New York Stock Exchange (NYSE). We have instituted a variety of practices to foster and maintain responsible corporate governance, which are described in this section. To learn more about Visa’s corporate governance and to view our Corporate Governance Guidelines, Code of Business Conduct and Ethics, and the charters of each of the Board’s committees, please visit the Investor Relations page of our website at investor.visa.com under “Corporate Governance.” Our Environmental, Social & Governance Report is located on our website at visa.com/esg. You may request a printed copy of any of these documents free of charge by contacting our Corporate Secretary at Visa Inc., P.O. Box 193243, San Francisco, CA 94119 or corporatesecretary@visa.com.

Al Kelly currently serves as Chairman and Chief Executive Officer, and John Lundgren serves as Lead Independent Director. While the Company does not have a policy on whether the roles of Chairperson and Chief Executive Officer should be split, the Board believes that the combined role is in the best interests of the Company and its stockholders at this time, as this structure allows Mr. Kelly to effectively manage the business, execute on our strategic priorities, and lead the Board, while empowering Mr. Lundgren to provide independent Board leadership and oversight. The Board believes that Mr. Kelly’s inclusive leadership style and decades of payments expertise make him uniquely qualified to lead discussions of the Board; foster an important unity of leadership between the Board and management; and promote alignment of the Company’s strategy with its operational execution. Upon effecting the Chief Executive Officer transition on February 1, 2023, the Board has determined that Mr. Kelly will continue to serve as Executive Chairman. Mr. Lundgren has significant experience as a CEO, including in a combined role of CEO and Chair, so he is familiar with the combined board leadership structure and the importance of building strong relationships with the various constituencies.

To further promote independent leadership, the Board has developed a robust set of responsibilities for the Lead Independent Director role, including:

calling, setting the agenda for, and chairing periodic executive sessions and meetings of the independent directors;

chairing Board meetings in the absence of the Chairperson or when it is deemed appropriate arising from the Chairperson’s management role or non-independence;

providing feedback to the Chairperson and Chief Executive Officer on corporate and Board policies and strategies and acting as a liaison between the Board and the Chief Executive Officer;

facilitating communication among directors and between the Board and management;

in concert with the Chairperson and Chief Executive Officer, advising on the agenda, schedule, and materials for Board meetings and strategic planning sessions based on input from directors;

coordinating with the Chair of the Nominating and Corporate Governance Committee, leading the independent directors’ involvement in Chief Executive Officer succession planning, selection of committee chairs and committee membership, and the Board evaluation process;

coordinating with the Chair of the Compensation Committee and leading the independent directors’ evaluation of Chief Executive Officer performance and compensation;

communicating with stockholders as necessary; and

carrying out such other duties as are requested by the independent directors, the Board, or any of its committees from time to time.

The Board periodically reviews the Board’s leadership structure and its appropriateness given the needs of the Board and the Company at such time.

In addition to our Lead Independent Director, independent directors chair the Board’s four standing committees: the Audit and Risk Committee, chaired by Lloyd A. Carney; the Compensation Committee, chaired by Denise M. Morrison; the Finance Committee, chaired by Robert W. Matschullat; and the Nominating and Corporate Governance Committee, chaired by Maynard G. Webb, Jr. In their capacities as independent committee chairs, Messrs. Carney, Matschullat, and Webb and Ms. Morrison each have responsibilities that contribute to the Board’s oversight of management, as well as facilitating communication among the Board and management.

Board of Directors and Committee Evaluations

Our Board recognizes that a robust and constructive Board and committee evaluation process is an essential component of Board effectiveness. As such, our Board and each of its committees conduct an annual evaluation facilitated by an independent third party, which includes a qualitative assessment by each director of the performance of the Board and the committee or committees on which the director sits. The Board also conducts an annual peer review, which is designed to assess individual director performance. The Nominating and Corporate Governance Committee, in conjunction with the Lead Independent Director, oversees the evaluation process.

Review of Evaluation | Advanced | One-on-One | Evaluation Results | |||

| NCGC reviews evaluation process annually | Covers: • Board efficiency and effectiveness • Board and committee composition • Quality of board discussions • Quality of information and materials provided • Board processes • Board culture | One-on-one discussions between independent, third-party facilitator and each director to solicit their views on the Board’s effectiveness | • Preliminary evaluation results are discussed with the NCGC Chair, Board Chair, and Lead Independent Director • Final evaluation results and recommendations are discussed with the Board, committees, and individual directors | |||

| Feedback Incorporated Over the past few years, the evaluation process has led to a broader scope of topics covered in the Board meetings, improvements in Board process, and changes to Board and committee composition and structure. This year’s evaluation identified areas for continued focus, including: • management, director, and committee succession planning; • enhancements to support board effectiveness; • risk management; and • Board composition in support of long-term strategy. | |

IndependenceIn addition to executive and management succession, the Nominating and Corporate Governance Committee regularly oversees and plans for director succession and refreshment of Directorsthe Board to cultivate a mix of skills, experience, tenure, and diversity that promote and support the Company’s long-term strategy. In doing so, the

Attendance at Board, Committee and Annual Stockholder Meetings

– Criteria for Nomination to the Board of Directors and Diversity. Individuals identified by the Nominating and Corporate Governance Committee as qualified to become directors are then recommended to the Board for nomination or election.

COMPENSATION OFNON-EMPLOYEE DIRECTORSIndependence of Directors

i

| ||||

| ||||

| ||||

ii

This summary highlights information contained elsewhere in this proxy statement. This summary does not contain all of the information that you should consider, and you should read the entire proxy statement carefully before voting.

INFORMATION ABOUT OUR 2018 ANNUAL MEETING OF STOCKHOLDERS

|

| |||

|

| |||

|

| |||

|

| |||

under “Corporate Governance.”

| In October 2022, with the assistance of legal counsel, our Board conducted its annual review of director independence and affirmatively determined that each of our non-employee directors (Lloyd A. Carney, Mary B. Cranston, Kermit R. Crawford, Francisco Javier Fernández-Carbajal, Ramon Laguarta, Teri L. List, John F. Lundgren, Robert W. Matschullat, Denise M. Morrison, Linda J. Rendle, and Maynard G. Webb, Jr.) is “independent” as that term is defined in the NYSE’s listing standards, our independence guidelines, and our Certificate of Incorporation. In addition, the Board previously determined that Suzanne Nora Johnson and John Swainson were “independent” while they served on the Board during fiscal year 2022.

|

VOTING MATTERS

CORPORATE GOVERNANCE AND BOARD HIGHLIGHTS

We are committed to corporate governance practices that promote long-term value and strengthen board and management accountability to our stockholders, customers and other stakeholders. Information regarding our corporate governance framework begins on page 7, which includes the following highlights:

Snapshot of 2018 Director Nominees

Our director nominees exhibit an effective mix of diversity, experience and perspectiveaudit committees:

| Director | Committee | Other Current Public | ||||||||||||||||

| Name | Age | Since | Principal Occupation | Independent | ARC | CC | NGC | Boards | ||||||||||

Lloyd A. Carney |

55 |

2015 |

Director |

|

|

– | ||||||||||||

Mary B. Cranston |

69 |

2007 |

Director |

|

|

2 | ||||||||||||

Francisco Javier | 62 | 2007 | Director General, Servicios Administrativos Contry SA de CV |  |

|

| 3 | |||||||||||

Gary A. Hoffman |

57 |

2016 |

CEO, Hastings Insurance Group |

|

|

1 | ||||||||||||

Alfred F. Kelly, Jr. | 59 | 2014 | CEO, Visa |

| 1 | |||||||||||||

John F. Lundgren |

66 |

2017 |

Director |

|

|

1 | ||||||||||||

Robert W. Matschullat | 70 | 2007 | Independent Chairman, Visa |  | 2 | |||||||||||||

Suzanne Nora Johnson |

60 |

2007 |

Director |

|

|

|

3 | |||||||||||

John A. C. Swainson | 63 | 2007 | Director |  |

|

| – | |||||||||||

Maynard G. Webb, Jr.

| 62 | 2014 | Founder, Webb Investment Network |

|

|

| 1 | |||||||||||

ARC = Audit and Risk Committee CC = Compensation Committee NGC = Nominating & Corporate Governance Committee

= Member

= Member  = Chair

= Chair

EXECUTIVE COMPENSATION HIGHLIGHTS

Highlights of Our Compensation Programs

Director Category | Limit on publicly-traded board and committee service, including Visa | ||

All directors | 4 boards | ||

Directors who are executives of a publicly-traded company | 2 boards | ||

| |||

| |||

| |||

| |||

| |||

| |||

| |||

| |||

|

| ||

| ||

| ||

| ||

| ||

Our Compensation Philosophy

We provide our named executive officers with short- and long-term compensation opportunities that encourage increasing performance to enhance stockholder value while avoiding excessive risk-taking.

| ||

| ||

| ||

We maintain compensation plans that tie a substantial portion of our named executive officers’ overall target annual compensation to the achievement of our corporate performance goals. The Compensation Committee employs multiple performance measures and strives to award an appropriate mix of annual and long-term equity incentives to avoid overweighting short-term objectives.

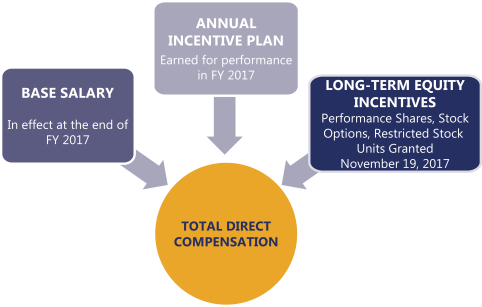

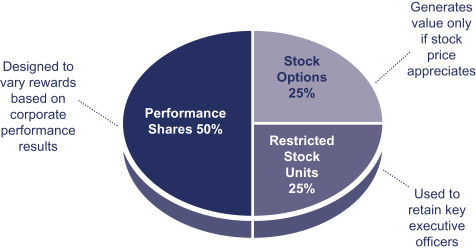

Key Elements of our Compensation Programs CEO Other NEOs Compensation Mix Annual Cash Incentive Long Term Equity Incentive Salary 8% Target Annual Incentive 20% Target Long-term Incentive 72% 92% at risk Salary 11% Target Annual Incentive 20% Target Long-term Incentive 69% 89% at risk Individual Performance 20% Corporate Performance 80% (Net Income Growth and Net Revenue Growth) Individual Performance 30% Corporate Performance 70% (Net Income Growth and Net Revenue Growth) Performance Shares 50% Restricted Stock Units 25% Stock Options 25%

COMPANY PERFORMANCE HIGHLIGHTS

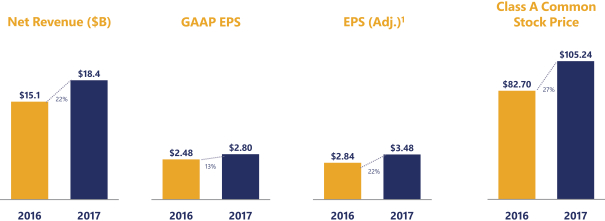

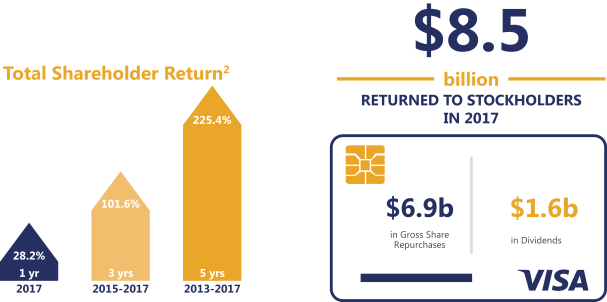

During the fiscal year ended September 30, 2017, Visa delivered strong financial results following our acquisition of Visa Europe and continued growth in our core operations. Net operating revenue increased 22% to $18.4 billion. GAAP net income increased 12% to $6.7 billion, while adjusted net income increased 21% to $8.3 billion.(1) Payments volume increased 41% to $7.3 trillion, while processed transactions grew 34% to 111 billion. Our class A common stock price increased 27%, and we returned $8.5 billion to stockholders in the form of share repurchases and dividends.

|

|

BOARD’S ROLE IN LONG-TERM STRATEGIC PLANNING

The Board takes an active role with management to formulate and review Visa’s long-term corporate strategy. In 2017, under the leadership of our new CEO, Alfred F. Kelly, Jr., Visa made several changes to the existing strategic framework. The strategic pillars were reframed as ‘foundational pillars’ – fundamental to maintaining Visa’s operational excellence and reputation as a trusted leader in the industry – and ‘growth pillars’ – critical for driving long-term sustained growth in a rapidly evolving landscape. A new strategic pillar, Leverage World-Class Brand, was added to highlight the importance of maximizing Visa’s brand to drive measurable outcomes for Visa and our partners. Our commitment to develop the best talent was placed at the center of the strategic framework, to reinforce how attracting, developing and retaining the best people globally is crucial to all aspects of Visa’s activities and long-term success.

The Board and management routinely confer on our Company’s execution of its long-term strategic plans, the status of key strategic initiatives and the key strategic opportunities and risks facing Visa. In addition, the Board periodically devotes meetings to conduct anin-depth long-term strategic review with our Company’s senior management team. During these reviews, the Board and management discuss the payments landscape, emerging technological and competitive threats, and short and long-term plans and priorities within each strategic pillar.

Additionally, the Board annually discusses and approves the Company’s budget and capital requests, which are firmly linked to Visa’s long-term strategic plans and priorities. Through these processes, the Board brings its collective, independent judgment to bear on the most critical long-term strategic issues facing Visa. For more information on our long-term strategy and the progress we made against our strategic goals in fiscal 2017, please see our 2017 Annual Report, including the letter from our CEO, Alfred F. Kelly, Jr., to our stockholders.

Strategic Framework

Our Board oversees the business of the Company to serve the long-term interests of our stockholders. Members of our Board oversee our business through discussions with our Chief Executive Officer, President, Chief Financial Officer, General Counsel, Vice Chairman and Chief Risk Officer and other officers and employees, and by reviewing materials provided to them and participating in regular meetings of the Board and its committees.

The Board regularly monitors our corporate governance policies and profile to ensure we meet or exceed the requirements of applicable laws, regulations and rules, and the listing standards of the New York Stock Exchange (NYSE). We have instituted a variety of practices to foster and maintain responsible corporate governance, which are described in this section. To learn more about Visa’s corporate governance and to view our Corporate Governance Guidelines, Code of Business Conduct and Ethics, Code of Ethics for Senior Financial Officers, and the charters of each of the Board’s committees, please visit the Investor Relations page of our website athttp://investor.visa.com under “Corporate Governance.” Copies of these documents also are available in print free of charge by writing to our Corporate Secretary at Visa Inc., P.O. Box 193243, San Francisco, CA 94119.

In October 2016, the Board appointed Alfred F. Kelly, Jr. as Chief Executive Officer, effective December 1, 2016, replacing Charles W. Scharf, who resigned as Chief Executive Officer effective December 1, 2016. The Nominating and Corporate Governance Committee and the Board believe having the Chair and Chief Executive Officer in separate roles is the most appropriate leadership structure for the Company at this time, by allowing Mr. Kelly to focus on theday-to-day management of the business and on executing our strategic priorities, while allowing our independent Chair, Robert W. Matschullat, to focus on leading the Board, providing advice and counsel to Mr. Kelly and facilitating the Board’s independent oversight of management. The Nominating and Corporate Governance Committee will continue to periodically review the Board’s leadership structure and to exercise its discretion in recommending an appropriate and effective framework on acase-by-case basis, taking into consideration the needs of the Board and the Company at such time.

As our independent Chair, Mr. Matschullat’s duties and responsibilities include: presiding at meetings of the Board and calling, setting the agenda for and chairing periodic executive sessions of the independent directors; providing feedback to the Chief Executive Officer on corporate policies and strategies; acting as a liaison between the Board and the Chief Executive Officer; and facilitatingone-on-one communication between directors, committee chairs, the Chief Executive Officer and other senior managers to keep abreast of their perspectives.

In addition to our independent Chair, the Board has three standing committees: the Audit and Risk Committee, chaired by Mary B. Cranston; the Compensation Committee, chaired by Suzanne Nora Johnson; and the Nominating and Corporate Governance Committee, chaired by John A.C. Swainson. In their capacities as independent committee chairs, Ms. Cranston, Ms. Nora Johnson and Mr. Swainson each have responsibilities that contribute to the Board’s oversight of management, as well as facilitating communication among the Board and management.

Board of Directors and Committee Evaluations

Our Board and each of our committees conduct an annual evaluation, which includes a qualitative assessment by each director of the performance of the Board and the committee or committees on which the director sits. The Board also conducts an annual peer review, which is designed to assess individual director performance. The evaluations and peer review are conducted via oral interviews by an independent, third party legal advisor selected by the Board, using as the basis for discussion a list of questions that are provided to each director in advance. The results of the evaluation and any recommendations for improvement are discussed with the Nominating and Corporate Governance Committee and the Board. The Nominating and Corporate Governance Committee oversees the evaluation process.

Over the past few years, the evaluation process has led to a broader scope of topics covered in the board meetings and improvements in board process. These improvements include changes relating to the preparation and distribution of board materials, as well as adjustments to the timing and location of board and committee meetings. The process has also informed board and committee composition, which includes changes to the director candidate skills and qualifications criteria.

Director Succession Planning and Board Refreshment

In addition to executive and management succession, the Nominating and Corporate Governance Committee regularly oversees and plans for director succession and refreshment of the Board to ensure a mix of skills, experience, tenure, and diversity that promote and support the Company’s long-term strategy. In doing so, the Nominating and Corporate Governance Committee takes into consideration the overall needs, composition and size of the Board, as well as the criteria adopted by the Board regarding director candidate qualifications, which are described in the section entitledCorporate Governance – Nomination of Directors. Individuals identified by the Nominating and Corporate Governance Committee as qualified to become directors are then recommended to the Board for nomination or election.

The NYSE’s listing standards and our Corporate Governance Guidelines provide that a majority of our Board and every member of the Audit and Risk, Compensation and Nominating and Corporate Governance committees must be “independent.” Our Certificate of Incorporation further requires that at least fifty-eight percent (58%) of our Board be independent. Under the NYSE’s listing standards, our Corporate Governance Guidelines and our Certificate of Incorporation, no director will be considered to be independent unless our Board affirmatively determines that such director has no direct or indirect material relationship with Visa or our management. Our Board reviews the independence of its members annually and has adopted guidelines to assist it in making its independence determinations. For details, see our Corporate Governance Guidelines, which can be found on the Investor Relations page of our website athttp://investor.visa.com under “Corporate Governance.”

In October 2017, with the assistance of legal counsel, our Board conducted its annual review of director independence and affirmatively determined that each of ournon-employee directors (Lloyd A. Carney, Mary B. Cranston, Francisco Javier Fernández-Carbajal, Gary A. Hoffman, Suzanne Nora Johnson, John F. Lundgren, Robert W. Matschullat, John A. C. Swainson and Maynard G. Webb, Jr.) is “independent” as that term is defined in the NYSE’s listing standards, our independence guidelines and our Certificate of Incorporation. In addition, the Board previously determined that Cathy E. Minehan and David J. Pang were “independent” while they served on the Board during fiscal 2017.

In making the determination that the directors listed above are independent, the Board considered relevant transactions, relationships and arrangements, including those specified in the NYSE listing standards and our independence guidelines, and determined that these relationships were not material relationships that would impair the director’s independence. In this regard, the Board considered that certain directors serve as directors of other companies with which the Company engages inordinary-course-of-business transactions, and that, in accordance with our director independence guidelines, none of these relationships constitute material relationships that would impair the independence of these individuals. Discretionary contributions to certain charitable organizations with which some of our directors are affiliated also were considered, and the Board determined that the amounts contributed to each of these charitable organizations in the past fiscal year were less than $120,000 and that these contributions otherwise created no material relationships that would impair the independence of those individuals.

In addition, each member of the Audit and Risk Committee and the Compensation Committee meets the additional, heightened independence criteria applicable to such committee members under the applicable NYSE rules.

Executive Sessions of the Board of Directors

Thenon-employee, independent members of our Board and all committees of the Board generally meet in executive session without management present during their regularly scheduledin-person board and committee meetings, and on anas-needed basis during telephonic and special meetings. Robert W. Matschullat, our independent Chair, presides over executive sessions of the Board and the committee chairs, each of whom is independent, preside over executive sessions of the committees.

Limitation on Other Board and Audit Committee Service

Our Corporate Governance Guidelines establish the following limits on our directors serving on outside publicly-traded company boards and audit committees:

| ||

| ||

| ||

Directors who serve on our Audit and Risk Committee | 3 audit committees |

The Nominating and Corporate Governance Committee may grant exceptions to the limits on a case-by-case basis after taking into consideration the facts and circumstances of the request. Our Corporate Governance Guidelines provide that prior to accepting an invitation to serve on the board or audit committee of another publicly-traded company, a director should advise our Corporate Secretary of the invitation. The Corporate Secretary will review the matter with the Lead Independent Director or the Chair of the Board, the Chair of the Nominating and Corporate Governance Committee, and the Chief Executive Officer, so that the Board, through the Nominating and Corporate Governance Committee, has the opportunity to review the director’s ability to continue to fulfill his or her responsibilities as a member of the Company’s Board or Audit and Risk Committee. When reviewing such a request, the Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee may grant exceptions to the limits on acase-by-case basis after taking into consideration the facts and circumstances of the request. The Guidelines provide that prior to accepting an invitation to serve on the board or audit committee of another publicly-traded company, a director should advise the Chair may consider a number of factors, including the director’s other time commitments, record of attendance at Board and the Nominating and Corporate Governance Committee of the invitation so that the Board, through the Nominating and Corporate Governance Committee, has the opportunity to review the director’s ability to continue to fulfill his or her responsibilities as a member of the Company’s Board or Audit and Risk Committee. When reviewing such a request, the Nominating and Corporate Governance Committee may consider a number of factors, including the director’s other time commitments, record of attendance at board and committee meetings, potential conflicts of interest and other legal considerations, and the impact of the proposed directorship or audit committee service on the director’s availability.

Mr. Carney serves as chief acquisition officer of Carney Technology Acquisition Corp. II (CTAC), a special purpose acquisition company (SPAC). Mr. Carney reports to the chief executive officer of CTAC and does not serve on the board of directors. Mr. Carney is not considered an executive of a publicly-traded company for purposes of the Board’s policy limiting service on other public company boards, given that service as an officer of a SPAC does not have the same demands as being an executive officer of a typical publicly-traded company.

Ms. List serves on three public company audit committees in addition to being a member of our Audit and Risk Committee. The Nominating and Corporate Governance Committee and the Board considered Ms. List’s service on four public company audit committees, including her professional qualifications, former experience as a public company chief financial officer, and the nature of and time involved in her service on other boards. Following such review, the Board determined that such simultaneous service would not impair the ability of Ms. List to effectively serve on the Company’s Audit and Risk Committee and waived the limit for service on the Audit and Risk Committee for Ms. List.

Management Development and Succession Planning

Our Board believes that one of its primary responsibilities is to oversee the development and retention of executive talent and to ensure that an appropriate succession plan is in place for our Chief Executive Officer and other members of management. Each quarter, the Nominating and Corporate Governance Committee meets with our Executive Vice President, Human Resources and other executives to discuss management succession and development planning and to address potential vacancies in senior leadership. The Nominating and Corporate Governance Committee also annually reviews with the Board succession planning for our Chief Executive Officer.

The Board of Directors’ Role in Risk Oversight

Our Board recognizes the importance of effective risk oversight in running a successful business and in fulfilling its fiduciary responsibilities to Visa and its stockholders. While the Chief Executive Officer, Vice Chairman and Chief Risk Officer and other members of our senior leadership team are responsible for theday-to-day management of risk, our Board is responsible for promoting an appropriate culture of risk management within the Company and for setting the right “tone at the top,” overseeing our aggregate risk profile and monitoring how the Company addresses specific risks, such as strategic and competitive risks, financial risks, brand and reputation risks, cybersecurity and technology risks, legal and compliance risks, regulatory risks and operational risks.

Board of Directors

In addition, each of the Committees meet in executive session with management to discuss our risk profile and risk exposures. For example, the Audit and Risk Committee meets regularly with our Chief Financial Officer, General Counsel, Vice Chairman and Chief Risk Officer, Chief Auditor, Chief Compliance Officer and other members of senior management to discuss our major risk exposures and other programs.

Stockholder Engagement on Corporate Governance, Corporate Responsibility and Executive Compensation Matters

Our Board and management team greatly value the opinions and feedback of our stockholders, which is why we have proactive, ongoing engagement with our stockholders throughout the year focused on corporate governance, corporate responsibility and executive compensation, in addition to the ongoing dialogue among our stockholders and our Chief Executive Officer, Chief Financial Officer and Investor Relations team on Visa’s financial and strategic performance.management.

Our Board and

|

management team greatly value the opinions and feedback of our | stockholders. We

several of our

| ||||||||||||||||||||||||||||||||||||||||||||

|

| |||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||

We contacted our Top 75

| Representing approximately 65% of our outstanding Class A common stock | |||

We held videoconference meetings with 48 stockholders | Representing approximately 26% of our outstanding Class A common stock | |||

Prior to Annual Meeting • We reach out to our top 75 investors to discuss corporate governance, sustainability, human capital management, and executive compensation matters, and solicit feedback. • Our Board is provided with our stockholders’ feedback for consideration. • Board and management discuss feedback and whether action should be taken. • Disclosure enhancements are considered. • We review vote proposals and solicit support for Board recommendations on management and stockholder proposals. | | Annual Meeting of Stockholders • Our stockholders vote on election of directors, executive compensation, ratification of our auditors, and other management and stockholder proposals. |  | Post Annual Meeting

• Our Board and management review the vote results from our annual meeting. • Board and management discuss vote results and whether action should be taken. • We start preparing our agenda for our next year of engagement. | ||||

Feedback from this year’s investor meetings was positive overall with many investors expressing appreciation for the increased transparency in our disclosures on ESG matters. Topics covered during our discussions with investors included:

our environmental footprint, climate change, and sustainable commerce, including Visa’s climate goals;

human capital management, including workforce diversity, equity, and inclusion;

Board leadership;

Board composition, skills, tenure, and diversity;

Board risk oversight, including cybersecurity, data privacy, brand and reputation, and legal and regulatory; and

our executive compensation program and philosophy, and ESG metrics in the annual incentive plan.

A summary of the feedback we received was discussed and considered by the Board, and enhancements have been made to certain of our disclosures to improve transparency.

Communicating with the Board of Directors

Our Board has adopted a process by which stockholders or other interested persons may communicate with the Board or any of its members. Stockholders and other interested parties may send communications in writing to any or all directors (including the Chair or the non-employee directors as a group) electronically to board@visa.com or by mail c/o our Corporate Secretary, Visa Inc., P.O. Box 193243, San Francisco, CA 94119. Communications that meet the procedural and substantive requirements of the process approved by the Board will be delivered to the specified member of the Board, non-employee directors as a group, or all members of the Board, as applicable, on a periodic basis, which generally will be in advance of or at each regularly scheduled meeting of the Board. Communications of a more urgent nature will be referred to the Corporate Secretary, who will determine whether it should be delivered more promptly. Additional information regarding the procedural and substantive requirements for communicating with our Board may be found on our website at investor.visa.com, under “Corporate Governance – Contact the Board.”

All communications involving accounting, internal accounting controls, and auditing matters, possible violations of, or non-compliance with, applicable legal and regulatory requirements or the Code of Business Conduct and Ethics, or retaliatory acts against anyone who makes such a complaint or assists in the investigation of such a complaint, may be made via email to businessconduct@visa.com; through our Confidential Compliance Hotline at (888) 289-9322 or our Confidential Online Compliance Hotline at visa.alertline.com; or by mail to Visa Inc., Business Conduct Office, P.O. Box 193243, San Francisco, CA 94119. All such communications will be handled in accordance with our Whistleblower Policy, a copy of which may be obtained by contacting our Corporate Secretary.

Attendance at Board, Committee, and Annual Stockholder Meetings

Our Board and management reviewits committees meet throughout the voting resultsyear on a set schedule, hold special meetings as needed, and act by written consent from our annual meeting.

•time to time. The Board met seven times during fiscal year 2022. Each director attended at least 94% or more of the aggregate of: (i) the total number of meetings of the Board held during the period in fiscal year 2022 for which he or she served as a director, and management discuss vote results and whether action should be taken.

• We start preparing our agenda for our next proxy season outreach.

Some of the topics discussed during this year’s stockholder engagement included board composition and refreshment, the board evaluation process, our executive compensation program and philosophy, and corporate responsibility. A summary of the feedback we received was provided to the Board for review and consideration, and enhancements have been made to our proxy statement disclosures to improve transparency in these areas. In addition, we held our 2017 Investor Day in June of this year, which provided an opportunity for our stockholders to hear directly from management on Visa’s long-term corporate strategy and ask questions of the management team.

Stockholders and other interested parties who wish to communicate with us on these or other matters may contact our Corporate Secretary electronically atcorporatesecretary@visa.com or by mail at Visa Inc., P.O. Box 193243, San Francisco, CA 94119.

Communicating with the Board of Directors

Our Board has adopted a process by which stockholders or other interested persons may communicate with the Board or any of its members. Stockholders and other interested parties may send communications in writing to any or all directors (including the Chair or thenon-employee directors as a group) electronically toboard@visa.com or by mail c/o our Corporate Secretary, Visa Inc., P.O. Box 193243, San Francisco, CA 94119. Communications that meet the procedural and substantive requirements of the process approved by the Board will be delivered to the specified member of the Board,non-employee directors as a group or all members of the Board, as applicable, on a periodic basis, which generally will be in advance of or at each regularly scheduled meeting of the Board. Communications of a more urgent nature will be referred to the General Counsel, who will determine whether it should be delivered more promptly. Additional information regarding the procedural and substantive requirements for communicating with our Board may be found on our website athttp://investor.visa.com, under “Corporate Governance – Contact the Board.”

All communications involving accounting, internal accounting controls, and auditing matters, possible violations of, ornon-compliance with, applicable legal and regulatory requirements or the Codes, or retaliatory acts against

anyone who makes such a complaint or assists in the investigation of such a complaint, may be made via email tobusinessconduct@visa.com, through our Confidential Compliance Hotline at(888) 289-9322 within the United States or the AT&T International Toll-Free Dial codes available online athttp://www.usa.att.com/traveler/access numbers/index.jsp outside of the United States, through our Confidential Online Compliance Hotline athttps://visa.alertline.com, or by mail to Visa Inc., Business Conduct Office, P.O. Box 193243, San Francisco, CA 94119. All such communications will be handled in accordance with our Whistleblower Policy, a copy of which may be obtained by contacting our Corporate Secretary.

Attendance at Board, Committee and Annual Stockholder Meetings

Our Board and its committees meet throughout the year on a set schedule, hold special meetings as needed, and act by written consent from time to time. The Board met 10 times during fiscal year 2017. Each director attended at least 75% or more of the aggregate of: (i) the total number of meetings of the Board held during the period in fiscal year 2017 for which he or she served as a director, and (ii) the total number of meetings held by all committees of the Board on which such director served as a member during the period in fiscal year 2017.(ii) the total number of meetings held by all committees of the Board on which such director served as a member during the period in fiscal year 2022. The total number of meetings held by each committee is listed below, under the headingCommittees of the Board of Directors. It is our policy that all members of the Board should endeavor to attend the annual meeting of stockholders. All nineten of our then-directorsthen directors attended the 20172022 Annual Meeting of Stockholders. Ms. List and Mr. LundgrenCrawford joined the Board in April 20172022 and October 2022, respectively and, therefore, did not attend the 20172022 Annual Meeting.

Our Board has adopted a Code of Business Conduct and Ethics, which applies to all directors, officers, employees, and contingent staff of the Company. Additionally, the Board has adoptedThis Code includes a supplemental Code of Ethics for SeniorCertain Executives and Financial Officers, which applies to our Chief Executive Officer, Chief Financial Officer, Controller, Chief People and Administrative Officer, General Counsel, and other senior financial officers, whom we refer to collectively as senior officers. These Codes require the senior officers to engage in honest and ethical conduct in performing their duties, provide guidelines for the ethical handling of actual or apparent conflicts of interest between personal and professional relationships, and provide mechanisms to report unethical conduct. Our senior officers are held accountable for their adherence to the Codes. If we amend or grant any waiver from a provision of our Codes for officers or directors, we will publicly disclose such amendment or waiver in accordance with and if required by applicable law, including by posting such amendment or waiver on our website athttp://investor.visa.com or by filing a current report on Form8-K with the Securities and Exchange Commission (SEC). within four business days.

Political Engagement and Disclosure

Public sector decisions significantly affect our business and industry, as well as the communities in which we operate. For this reason, we participate in the political process through regular and constructive engagement with government

officials and policy-makers, by encouraging the civic involvement of our employees, and by contributing to candidates and political organizations where permitted by applicable law. We are committed to conducting these activities in a transparent manner that reflects responsible corporate citizenship and best serves the interests of our shareholders,stockholders, employees, and other stakeholders. Additional information regarding our political activities and oversight may be found athttps://usa.visa.com/about-visa/esg/operating-responsibly.html.

Visa has a Political Participation, Lobbying and Contributions Policy (PPLC Policy) that prohibits our directors, officers, and employees from using Company resources to promote their personal political views, causes, or candidates, and specifies that the Company will not directly or indirectly reimburse any personal political contributions or expenses. Directors, officers, and employees also may not lobby government officials on the Company’s behalf absent thepre-approval of the Company’s Global Government RelationsEngagement department. As such, our lobbying and political spending seek to promote the interests of the Company and its stockholders, and not the personal political preferences of our directors or executives.

Under the PPLC Policy, the Nominating and Corporate Governance Committee mustpre-approve the use of corporate funds for political contributions, including contributions made to trade associations to support targeted political campaigns and contributions to organizations registered under Section 527 of the U.S. Internal Revenue Code to support political activities. The PPLC Policy further requires the Company to make reasonable efforts to obtain from U.S. trade associations whose annual membership dues exceed $25,000 the portion of such dues that are used for political contributions. This information must then be included in the annual contributions reportsemiannual contribution reports that isare posted on our website.

We endeavor to maintain a healthy and transparent relationship with governments around the world by communicating our views and concerns to elected officials and policy-makers. As an industry leader, we encounter challenges and opportunities on a wide range of policy matters. These issues may include regulations and policies on interchange fees, cyber security,cybersecurity, data security, privacy, intellectual property, surcharging, payroll and prepaid cards, mobile payments, tax, international trade and market access, and financial inclusion, among others.

The Nominating and Corporate Governance Committee annually reviews our political contributions and lobbying expenditures on a semiannual basis, which includes information regarding memberships in, or payments to,tax-exempt organizations that write and endorse model legislation. Additional information on our political contributions and lobbying expenditures can be found on our website, including our annual contributions reportsemiannual contribution reports and links to our quarterly U.S. federal lobbying activities and expenditures reports.

In 2017,2022, the Center for Political Accountability assessed our disclosures for its annual Center for Political Accountability CPA-Zicklin Index of Corporate Political Disclosure and Accountability, known as theCPA-Zicklin Index. TheCPA-Zicklin Index measures the transparency, policies and practices of the S&P 500 with respect to political disclosures.designated Visa was designated a “trendsetter”“Trendsetter” (the highest designation in theCPA-Zicklin Index) with a perfect score of 94.3 out of 100.

Corporate ResponsibilityEnvironmental, Social, and SustainabilityGovernance

The Nominating and Corporate Governance Committee of our Board oversees Visa’s corporate responsibility initiatives. We believe that as a trusted brand in payments, Visa has a tremendousan opportunity and responsibility to use our businesscontribute to connect the world – enabling economic growtha more inclusive, equitable, and strengthening economies while also helping improve lives and create a bettersustainable world. WeAs we work toward this goal, we are committed to managing the risks and opportunities that arise from environmental, socialESG issues, providing transparency of our ESG performance, and governance (ESG) issues.enabling strong executive and Board oversight of our overall ESG strategy. In fiscal year 2022, the Board, in full and in individual committees, discussed a range of ESG topics, including but not limited to human capital management, inclusion and diversity, climate strategy, political engagement and contributions, technology, cybersecurity, and data privacy.

As detailed below, Integrated Approach

Visa takesstrives to be an industry leader in addressing ESG issues and overall management. To do so, we continue to take an integrated approach to managingour ESG performance and transparency.

Materiality-based Strategy: In line with international ESG guidelines and corporate best practices, Visa conducts a biennial ESG materiality assessment, which enables us to monitor and reassess our approach to managing priority topics. Visa ’s overall approach to ESG focuses on identifying relevant and significant topics that align Visa’s long-term business strategy and success with the importance of those topics to our stakeholders, including employees, clients, investors, ESG ratings agencies, governments, civil society organizations, communities, and others.

| • | Governance: At the Board level, the Nominating and Corporate Governance Committee has formal responsibility to oversee and review our management of ESG matters, overall ESG strategy, stakeholder engagement, formal reporting, and policies and programs in specific areas, including environmental sustainability, climate change, human rights, political activities and expenditures, social impact, and philanthropy. These responsibilities are incorporated into the charter for the Nominating and Corporate Governance Committee, which is available on the Investor Relations page of our website at investor.visa.com under “Corporate Governance – Committee Composition.” |

Engagement: Understanding the views of Visa stakeholders supports our work across our business and ESG strategic priorities. We regularly engage with our stakeholders to help inform our ESG strategy, priorities, and actions.

Reporting: Visa is committed to providing transparency regarding our ESG approach and performance through various channels and platforms of ESG reporting. We publish our ESG Report annually, which consists of governance, engagementis aligned with leading reporting frameworks, such as those from the Global Reporting Initiative (GRI), the Sustainability Accounting Standards Board (SASB), relevant World Economic Forum (WEF) Stakeholder Capitalism Metrics, and others. In addition, we participate in:

Additional reporting initiatives such as CDP and the Workforce Disclosure Initiative (WDI);

Engagements with ESG ratings firms;

ESG-focused rankings and lists; and

Ongoing dialogue with stakeholders on our initiatives.ESG performance.

Key Focus Areas of ESG Strategy and Recent Progress

Our ESG strategy focuses on priority issues in five areas, each of which is informed by our materiality assessment and stakeholder engagement.

Empowering People, Communities, and Economies • Digital Equity • Financial Access • Small and Micro Businesses • Empowering Women • Local Communities |

|

Helped digitally enable over 40 million small and micro businesses (SMBs) as of September 2022, as we work toward our goal to digitally enable 50 million SMBs worldwide

✓ Shared global insights through the Visa Economic Empowerment Institute on digital equity, SMB digitization, and ✓ Supported more than work

inclusive small businesses globally | ||||||

Investing in our Workforce • Inclusion and Diversity • Learning and Development • Employee Engagement • Benefits and Wellbeing • Employee Safety |

| ✓ Made progress towards our goal to increase representation of employees from underrepresented groups in our U.S. leadership and broader workforce

✓ Welcomed the inaugural cohort of Visa Black Scholars to our first Visa Black Scholars Summit ✓ Held the fourth annual Visa Learning Festival with more than 50 virtual sessions and in-person events, with nearly 30% of employees registered to participate ✓ Launched the Visa Career Development Framework with digital tools to drive employee growth, mobility, and engagement ✓ Announced New Child Bonding Leave, which sets a global minimum of 14 weeks paid leave for all parents | ||||||

| ||||||||

• Payments Security • Cybersecurity • Consumer Privacy • Responsible Data Use • Transaction Integrity |

|

✓ Deployed artificial intelligence-enabled capabilities and always-on experts to proactively detect and prevent billions of dollars of attempted fraud ✓ Promoted the adoption of scalable technologies, such as network tokenization and 3DS, that enhanced transaction security globally ✓ Achieved the highest rating in our sector from Gartner Consulting during our 2022 cybersecurity program review ✓ Enhanced the Visa Global Privacy Program to anticipate increased and evolving privacy regulations and consumer expectations ✓ Decreased enumeration attack volumes with new analytical capabilities, enhanced tools, and the launch of a targeted compliance program | ||||||

• Visa • Sustainable Commerce |  |

Informed by a formal process to understand the ESG issues that are at the intersection of importance to our stakeholders as well as our long-term success, our approach focuses on topics in five areas:

In 2017, Visa was recognized for our corporate responsibility progress, including through the following: